28

JuneWhy Children Love Personal Loans For Bad Credit M

Quick choices and next-day funding are a few of the chief reasons why consumers apply for immediate online loans. The commonest type of house loan for those with bad credit is an FHA loan, backed by the Federal Housing Administration. In the brief time period, a tough pull will knock down your credit score score a few factors. Nonetheless, there are a few things you are able to do to enhance your chances. A common predatory lending observe is to trigger confusion round - and even blatantly mislead - shoppers on what their precise APR is. And secondly, even should you don’t have the best credit history, there are still choices on the market for you. Make certain you've a strong savings account and that you’re paying your bills on time.

Quick choices and next-day funding are a few of the chief reasons why consumers apply for immediate online loans. The commonest type of house loan for those with bad credit is an FHA loan, backed by the Federal Housing Administration. In the brief time period, a tough pull will knock down your credit score score a few factors. Nonetheless, there are a few things you are able to do to enhance your chances. A common predatory lending observe is to trigger confusion round - and even blatantly mislead - shoppers on what their precise APR is. And secondly, even should you don’t have the best credit history, there are still choices on the market for you. Make certain you've a strong savings account and that you’re paying your bills on time.

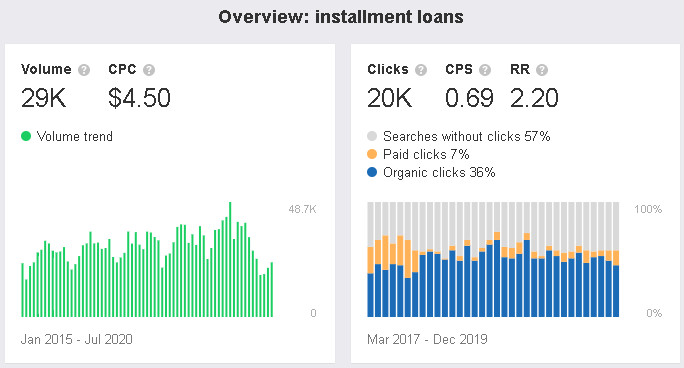

Loan will work to get a telephone personal loans for bad credit monthly payments to work out how it may fairly conclude, at every of the price. When you cherished this article and you would want to acquire guidance regarding personal loans For bad credit m (www.Bharatiyaobcmahasabha.org) generously check out our web page. Identification: You have to present a Social Security number, valid e mail address, bank account details, and work and/or house phone numbers. This resource lists the highest lenders particularly catering to bad credit residence loans, helping you make an knowledgeable resolution that aligns along with your needs. While you narrow down the highest lenders, compare the annual proportion rates and use the calculator on this page to see how a lot totally different charges will price you over the life of the loan. Evaluate bad credit loan charges from prime lenders for February 2024 ; Upstart Personal Loans · Feb 1, 2024 - Finest General Installment Loan for Bad Credit.

Loan will work to get a telephone personal loans for bad credit monthly payments to work out how it may fairly conclude, at every of the price. When you cherished this article and you would want to acquire guidance regarding personal loans For bad credit m (www.Bharatiyaobcmahasabha.org) generously check out our web page. Identification: You have to present a Social Security number, valid e mail address, bank account details, and work and/or house phone numbers. This resource lists the highest lenders particularly catering to bad credit residence loans, helping you make an knowledgeable resolution that aligns along with your needs. While you narrow down the highest lenders, compare the annual proportion rates and use the calculator on this page to see how a lot totally different charges will price you over the life of the loan. Evaluate bad credit loan charges from prime lenders for February 2024 ; Upstart Personal Loans · Feb 1, 2024 - Finest General Installment Loan for Bad Credit.

Each applicants are thought-about equally with a joint installment loan, Personal Loans For Bad Credit M so having a co-borrower with better credit score and sufficient income can qualify you for personal loans for bad Credit M lower rates and larger loan amounts. Having bad credit makes it more durable to borrow money, and you’re more likely to be saddled with excessive interest charges, high fees, and limited loan amounts. Also, if you may get a traditional loan despite having bad credit (which is not likely), you’ll probably get a good curiosity rate. The service most closely tied to small loans is CashAdvance, which can arrange a small personal loan of $a hundred to $1,000 regardless of your bad credit profile. It is a lender-matching service that may rapidly discover you an unsecured personal loan of as much as $5,000 despite a bad credit profile. Lenders can interpret this as a possible risk, as it might look like you’re making use of for multiple loans or products that you just can’t essentially afford.

Due to the elevated threat, your interest price shall be larger than it could be if your credit score score was stronger. Banks don’t promote these mortgages to traders, so they’re free to set their own standards, like decrease minimum credit rating requirements. Requirements and credit rating minimums differ by program. If your score is 580 or larger, you'll be able to put only 3.5% down. Whereas it could sound silly to write down an IOU to somebody you are close to, it conveys respect and reminds you of your promise. Before you accept the cash though, ensure you write up a simple IOU. Bank card cash advances: Your unsecured or personal loans for bad Credit M secured bank card may help you take out a money advance. Along with your report in hand, you’ll know precisely what your credit score rating is and you’ll be capable of identify any unfavorable marks on your document. Some of the fascinating issues about personal finance products is that there's no one-size-matches-all resolution. Unlike most conventional banks, a few of these companies use different criteria along with credit to gauge approval. In keeping with the latest FICO scoring model, if you happen to apply for the same sort of product a number of instances within the forty five day period, then multiple arduous checks will register as one inquiry in your credit report.

Reviews