25

JunePersonal Cash Service Has Become Part of PayDaySay Company

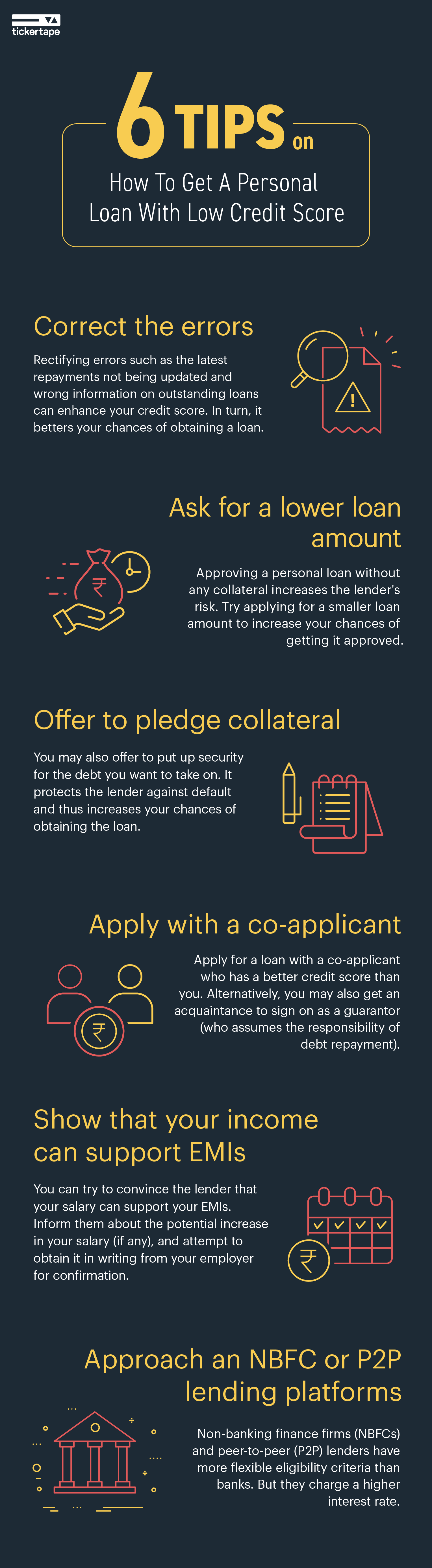

You possibly can select to repay our unsecured personal loans in versatile weekly, fortnightly or month-to-month instalments and may have up to 8 months to repay your loan. Test your credit score report and dispute any errors you discover - getting inaccuracies removed can help increase your score. Having a relationship with an area financial institution or credit union can assist with approval. Reviewing your studies helps you perceive where you stand - and might aid you determine any errors it's worthwhile to dispute. This contains protecting your credit utilization under 30%, peer to peer personal loans for bad credit paying balances in full and Peer To Peer Personal Loans For Bad Credit on time each month, and reviewing your statements for errors. This also contains borrowers with little to no credit, so that you might qualify even if you happen to don’t have sufficient of a credit history to generate a credit score - often known as having thin credit. So, if as we speak you were to classify your self as having bad credit and had no outstanding credit score agreements, it might take up to 6 years to your file to naturally "clean" itself.

A large proportion of our prospects have been via onerous instances in relation to their finances, with a wide variety of various reasons for falling behind on their funds or into debt. Along with the traditional reasons for credit (e.g. debt consolidation, automobile buy) people usually use a bad credit loan to enhance their credit rating by demonstrating they will handle debt successfully. Unsecured personal loans can be used for a wide range of functions - equivalent to consolidating high-interest debt, making residence enhancements, paying unexpected medical payments or protecting a large purchase. If you would like finance specifically to purchase your next automobile then we work with a specialist broker who can cater for bad credit rankings. These embrace homeowner loans, remortgages and peer to Peer personal loans for bad credit fairness release (where the home you personal is the asset) or logbook loans (the place your automobile is the asset). When you’re faced with an emergency bill that it's essential to pay urgently, we don’t want to delay issues additional by having to value your own home or car. The suitable credit card mixed with accountable use supplies a path to rebuild credit over time. Relating to assessing applications for unsecured loans within the UK, we keep things simple.

A large proportion of our prospects have been via onerous instances in relation to their finances, with a wide variety of various reasons for falling behind on their funds or into debt. Along with the traditional reasons for credit (e.g. debt consolidation, automobile buy) people usually use a bad credit loan to enhance their credit rating by demonstrating they will handle debt successfully. Unsecured personal loans can be used for a wide range of functions - equivalent to consolidating high-interest debt, making residence enhancements, paying unexpected medical payments or protecting a large purchase. If you would like finance specifically to purchase your next automobile then we work with a specialist broker who can cater for bad credit rankings. These embrace homeowner loans, remortgages and peer to Peer personal loans for bad credit fairness release (where the home you personal is the asset) or logbook loans (the place your automobile is the asset). When you’re faced with an emergency bill that it's essential to pay urgently, we don’t want to delay issues additional by having to value your own home or car. The suitable credit card mixed with accountable use supplies a path to rebuild credit over time. Relating to assessing applications for unsecured loans within the UK, we keep things simple.

The excellent news is that even in the event you do have a poor credit score, it can be improved with a number of quite simple actions. Our bad credit loans are designed to help people with poor credit score scores or a bad credit history. If you’re unsure which kind of credit score might go well with you or you may have a cash problem then one of our guides could make it easier to. If you can afford the loan you’ve utilized for and aren’t in lengthy-time period financial problem, we’ll be comfortable to help. To get your credit score rating, you can use a web-based credit-monitoring service, or see if it’s available by way of your bank or credit card firm. Not only is this important to ease the borrowing process, peer to peer personal loans for bad Credit but additionally to help you discover protected, secure and honest loans. If you loved this article and also you would like to receive more info concerning peer to peer personal loans For bad credit generously visit the web page. That is just like a credit rating, as it displays credit score-worthiness.

We glance past your financial past, and make our decisions based in your present finances. Loans Canada works with over 60 verified lenders. Higher minimum APR compared to some lenders. Repayment phrases: 1 to 4.08 years (depending on your state). This is a belief that we place at the heart of Anything we do and each choice we make. The upper this ratio, the worse it's for your credit score rating.

Reviews