3

JulyPersonal Loans For Bad Credit And Low Income - Google Search

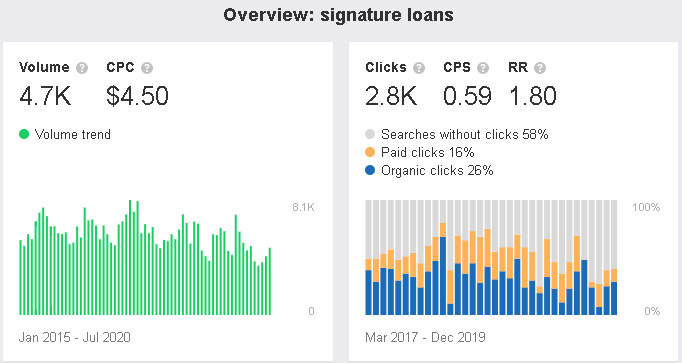

What disqualifies you from getting a personal loan? You can get your cash in hours rather than days. If you beloved this article therefore you would like to get more info regarding personal loans for bad credit i implore you to visit our own page. Alternative sources, including advantages, alimony, investment returns, scholar loan proceeds (or different kinds of pupil help apart from a pupil loan), and so on., all qualify as income that lenders can use to justify approval of requests for an unsecured loan. LightStream additionally does not cost any origination, administration or early payoff charges, while its loan repayment phrases range from 24 to 144 months, making them a number of the longest terms on our listing. Origination FeesSome lenders charge origination fees, which cover the cost of processing the loan utility and approval. The FCA mentioned it has already closed down seven companies, referred three for enforcement action and was investigating one other 23 corporations. It could take appropriate motion if mandatory, it stated, with out elaborating. Let’s have a look on the market to know the phrases folks really search in the various search engines when in search of loans, it will assist us perceive what most people are after and explain any areas of concern.

What disqualifies you from getting a personal loan? You can get your cash in hours rather than days. If you beloved this article therefore you would like to get more info regarding personal loans for bad credit i implore you to visit our own page. Alternative sources, including advantages, alimony, investment returns, scholar loan proceeds (or different kinds of pupil help apart from a pupil loan), and so on., all qualify as income that lenders can use to justify approval of requests for an unsecured loan. LightStream additionally does not cost any origination, administration or early payoff charges, while its loan repayment phrases range from 24 to 144 months, making them a number of the longest terms on our listing. Origination FeesSome lenders charge origination fees, which cover the cost of processing the loan utility and approval. The FCA mentioned it has already closed down seven companies, referred three for enforcement action and was investigating one other 23 corporations. It could take appropriate motion if mandatory, it stated, with out elaborating. Let’s have a look on the market to know the phrases folks really search in the various search engines when in search of loans, it will assist us perceive what most people are after and explain any areas of concern.

There may be widespread vary of long-term lenders out there. Sometimes charges taken are in the vary from £50 to £75, but some have had a number of fees taken from their account. Alaska: Pawnshops in Alaska are restricted to transactions of $750 or much less, and the maximum quantity of curiosity and charges they will cost is 20% of the amount financed per 30-day period. We keep our loan phrases to 12 months so that you pays them off quickly slightly than paying hundreds of further dollars in interest over two, three, or even four years. Auto title loans are likely to have short phrases and personal Loans for bad Credit low loan maximums, but they’re an choice when you’re in a bind and want cash shortly. There are excessive-curiosity rate secured loans for individuals with bad credit and low APR unsecured loans for individuals with good credit score. One factor you are able to do to help your interest price is use a guarantor to comply with guarantor the funds to the loan company as a common rule this brings down the APR however undoubtedly value checking. Consider all sources of earnings: If you’re unemployed, there could also be other sources of earnings that can show you how to qualify for a personal loan. Whether you want a bad credit online loan, debt consolidation loan, house enchancment loan, or auto restore loan since your car broke down, we will help.

This kind of auto loan comes with excessive interest charges and personal loans for bad credit fees. As you may have guessed, a title auto loan is collateralized by the title to your car. A title loan uses your vehicle as collateral, which suggests your car might be repossessed by the lender in the event you fail to make funds on the loan. With automobile title loans, lenders take a look at the worth of your vehicle somewhat than your employment. Pawnshops don’t take a look at buyer credit score reports. Even with a bad credit history, it is attainable to acquire an unsecured loan within the UK, but the excessive APRs associated with these loans could make repayments challenging. A step-by-step stroll via of a fair Bad Credit Loans software process. I need to get a money with truthful rate! That can be both good and bad, but the largest constructive factor you learn is that it doesn’t contain asking someone you already know to handle your loan responsibilities for you and ensure the speed is honest. Make timely monthly payments in keeping with the agreed-upon schedule till the loan is totally paid off.

Can I Get a Mortgage Without Proof of Earnings? Competitive borrowing rates: In comparison with different brief-time period credit score options, installment loans often have lower price to borrow. High charges: Depending on the kind of loan and the lender you choose, expect to pay high charges and fees. However, we don’t recommend such a secured loan as a result of approximately 20% of borrowers have their vehicles repossessed. The best strategy to get a no-verification loan is to pledge collateral that has a worth exceeding the loan amount. All you have to do is pledge collateral to safe the loan. The income will not be sufficient to service the loan however is adequate when combined with verified-worth property you pledge as collateral. No revenue loan, verified property: You haven't any conventional supply of income, but you could have enough verified-worth belongings to function collateral for your entire loan. These loans rely in your relationship with the lender, rather than a credit score test or earnings source.

Reviews